Healthcare players must adapt to the digital patient journey

We all see the digital health sector evolving quickly, with the digitalisation of the patient journey at its centre. It’s driven by new players entering the market to push innovation and challenge traditional

stakeholders to react.

Scroll down

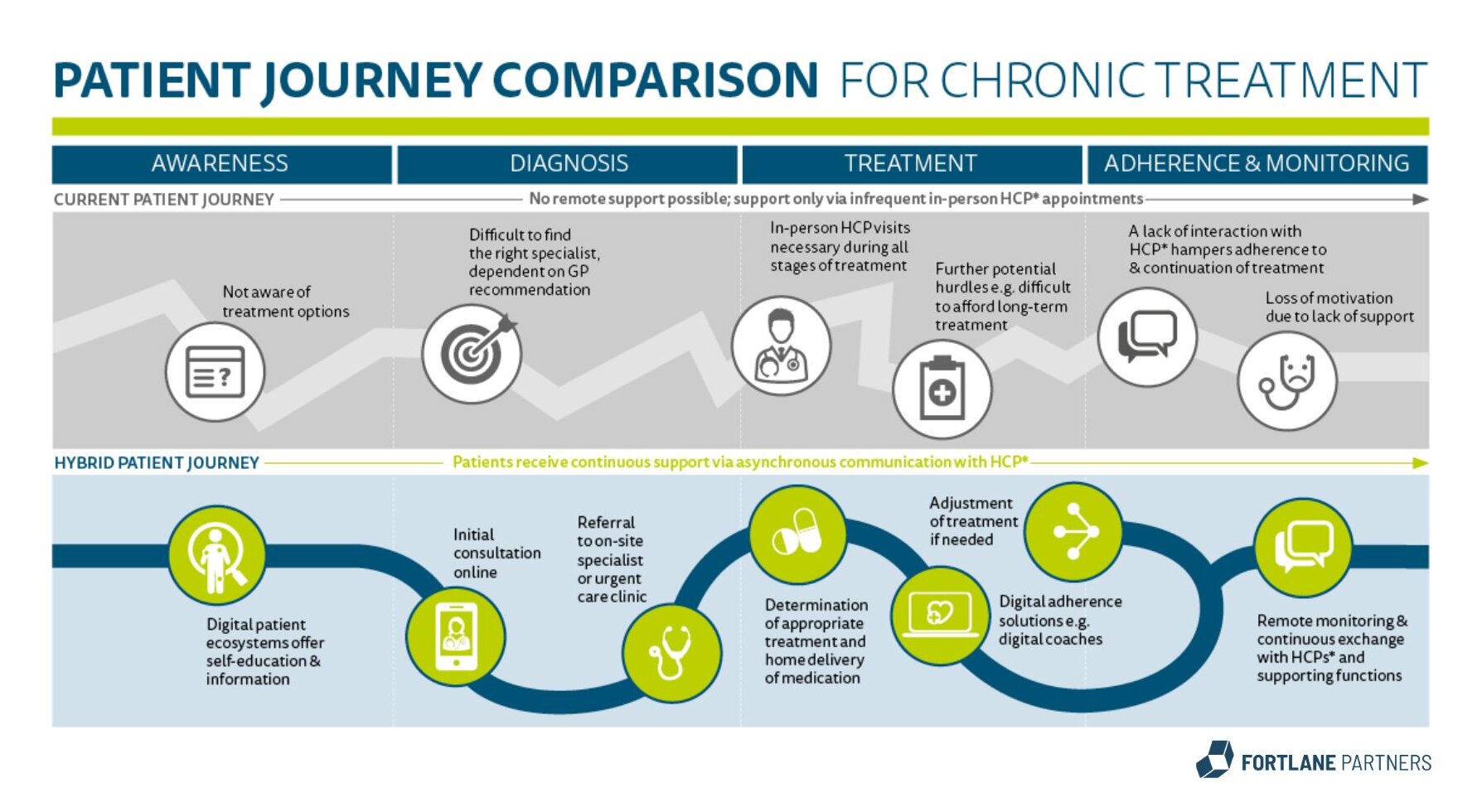

Moving to a data-driven care system will take the patient journey to the next level, where improved triaging, access and precision care are becoming a reality. However, today, the patient journey is often disjointed with no smooth transition between the individual phases. The good news is that patients themselves are the driving force behind the evolution of their journey, increasingly demanding more convenient and higher-quality services from medical care providers.

We’d like to shed light on the patient journey and its potential for optimisation – focusing on the German healthcare market. Why is Germany lagging behind? What does the future hold and what are the consequences for the various players?

Is the healthcare system finally evolving into a patient-centric system?

An uncomfortable journey

Currently, within the different phases of the patient journey, communication between doctors and patients is poor. Patients are relying on a practitioner’s treatment recommendation provided during a brief, rushed in-person visit.

The possibility to switch from synchronous, analogue conversations with the doctor to asynchronous chats in a hybrid setting, with the option to provide remote support for the patient, is a game changer. Consequently, treatments will become more personalised and precise with data from wearables and bolstered by AI, diagnostic kits for home use and continuous support from healthcare providers.

Telemedicine support (e.g. via teleclinic, kry, etc.) will simplify diagnoses, follow-up and treatment adherence (e.g. Liva Healthcare) and novel platforms are developing ecosystems for all patient concerns (e.g. Wellster Healthtech, gesund.de), while VIMPROs (Vertically Integrated Micro- Providers) offer indication-specific, end-toend therapy. In short: a new era of diagnosis and care is developing, but has not yet been implemented.

Spot on: Germany

In 2019, a Digital Health Care Act (DVG) was passed with the aim of improving the system through digital innovation. Since then, the German healthcare system has played a crucial role and acted as an internationally recognised pioneer in the field of digital therapeutics (e.g. by introducing Digitale Gesundheitsanwendungen [digital health applications]). Furthermore, the DVG enhances the development of secure digital infrastructures and permissions for telemedical consultations.

Despite this new legislation, we have to say that Germany still lags behind North America and China in digitising the patient journey. From our perspective, this is due to three key circumstances that are different in the three countries:

Figure 1: Patient journey comparison

- Regulatory "brakes"

The heterogeneous yet strict regulatory framework that still exists in Germany slows down the effective roll-out of digital infrastructures. In the US, telemedical players have already moved into higher-value care areas. For example, Cigna, the 4th largest medical insurer, has decided to play an active role by acquiring prominent telehealth providers such as MDLive in 2021.

In China, the government has set a national goal of “Healthy China 2030”. As a result, public efforts are made to improve the healthcare system through smart hospitals and telemedicine services. Private enterprises such as Tencent with its communication platform WeChat, are entering the healthcare market. It has integrated essential features like personal health records to become the central point of usage for personal health. In Germany, such integrations would not be possible due to strict data protection laws. As a result, key software for data exploitation is not based in Germany, but in Asia and North America. - More venture capital inflows

Money flows where the attention goes - and vice versa. Looking at the current market size and expected market growth for digital health, the EU market in 2019 was €6.8bn, expected to grow to €33bn by 2026. In contrast, in the US, the market accounted for €84bn in 2019 (China: €34bn), building up to €220bn (China: €304bn). This corresponds to an investment volume 5-12 times higher in the US and China and proves the delayed attention shift to digital health in Europe. Today, venture capital investment in Europe has reached record levels, and it has never been easier to obtain solid funding for European start-ups. A solid base is in place on which to build. - A seismic cultural shift

- With China’s utilitarian approach to digitisation for the greater good and the US openness to innovation and change, Germans lacked this particular attitude towards transformation until COVID broke the ice. German “digital maturity” took time to develop - but now it’s here, and patients are demanding change.

- Thus, stakeholders will need to be objectively assessing their digital maturity and monitor their Net Promoter Score (NPS) with patients. Other industries, such as the eCommerce sector and online banking, are way ahead and setting a new standard in convenience. Convenience is indeed the key factor in the digital value chain, where ecosystems are built around the consumer. The same is true for healthcare: care provision will become much more patient-centric.

- Therefore, players who add value by developing a convenient, personalised service for patients that is also trustworthy and evidence-based, will gain market share with patients. The patient journey will become a customer journey, allowing seamless and integrated access to healthcare products and services.

Figure 2: Success Factors

Summary

The American and Chinese examples show routes of transformation within the guard rails of regulation, innovation capital and cultural acceptance. However, this look abroad also reveals that in Germany, stakeholders must come up with solutions that comply with the more stringent local data protection framework and focus transformation on the many areas which are not encumbered by the slower speed of regulatory change.

Another prerequisite to achieve a seamless patient journey is cooperation between all stakeholders. We are convinced that strategic partnerships are the key to success here. To retain and gain market share, players will need to wake up, transform their traditional business models and reach out to new partners to compete in today’s world of emancipated and digitally native patients.

Sources: Fortlane Partners research

KontaktSprechen Sie uns an