Striving for omnichannel excellence in telecoms

It is well known that the rapidly changing customer behavior and the ongoing trend of digitalization will lead to a fundamental shift from offline toward online channels. Additionally, the capital-intensive rollout of new technologies (e.g., fiber rollout, 5G deployment) requires cost reductions, triggering telcos’ intrinsic motivation to shift to cheaper online channels.

Scroll down

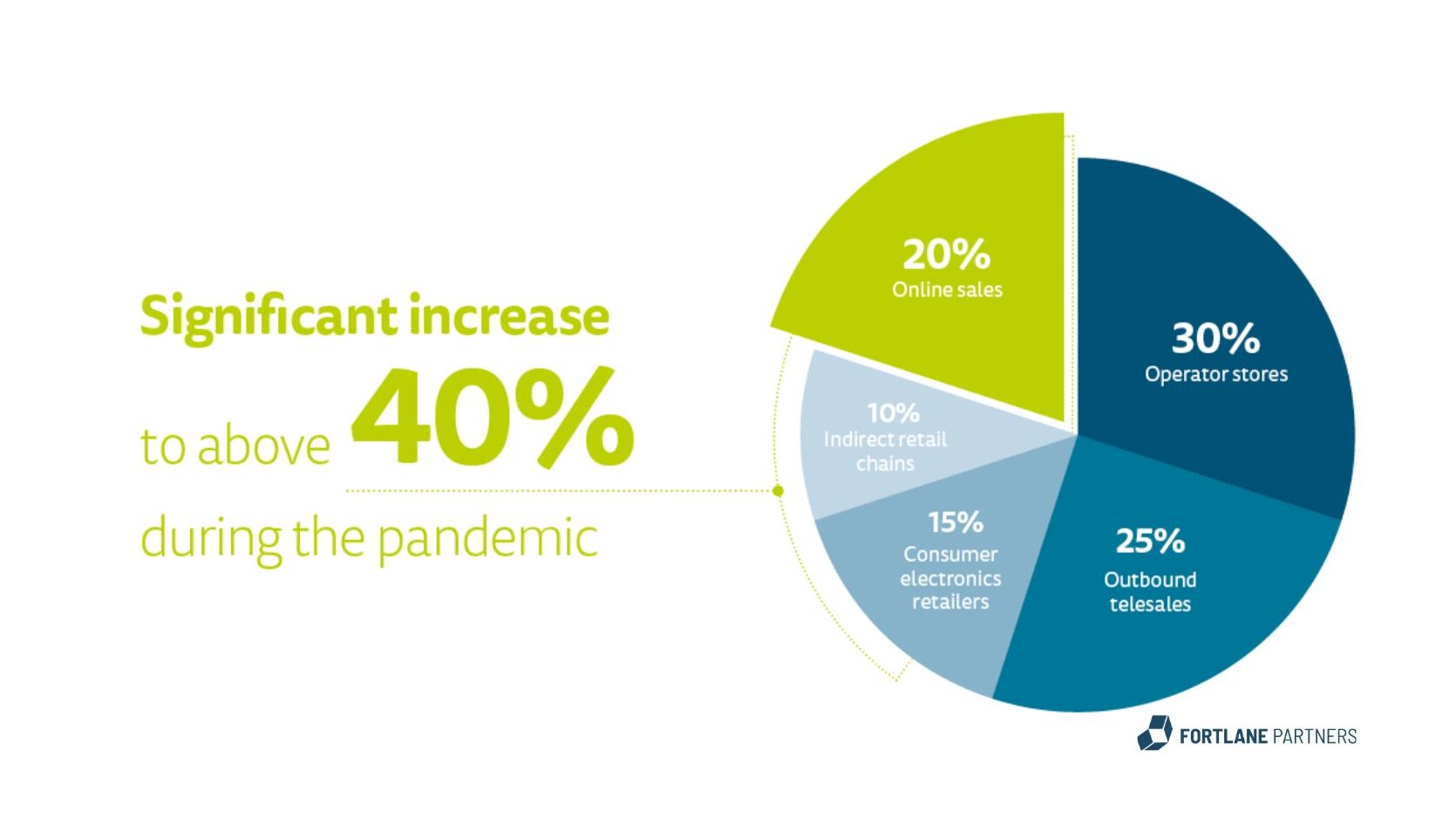

In contrast to these observations, from a sales perspective, the channel mix of telcos before COVID-19 only slightly changed, and operator stores and outbound sales channels still accounted for the majority of sales: In many cases, operator stores accounted for ~30% of sales, followed by outbound telesales accounting for almost 25% of sales. Consumer electronics retailers contributed ~15% and other indirect retail chains ~10% of sales volume. This clearly shows that offline sales channels are still key, while online sales seemed to stagnate in their contribution, making up for ~20% within the channel mix.

Without a doubt, COVID-19 and its consequences significantly accelerated the shift toward online channels (e.g., lockdowns with physical shops closed, changing retail experience, and customer expectations). This acceleration enforces the opportunity for telcos to revisit and rethink the traditional retail environment, change their retail sales approach, and adapt their channel mix accordingly in the future.

Retail footprint optimization

Fortlane Partners evaluated various scenarios that telcos must consider when rethinking their retail footprint strategy. As a matter of fact, we observed that most telcos rethought their footprint strategy and questioned the number of their shops. This overarching reduction of physical sales points is ongoing. Over the last five years, leading European telcos started to reduce the number of physical sales points. Footprint reduction targets range between 15% to 30% of total points of sales, whereas smaller telco operators are planning a >50% reduction. Various parameters such as white spots in the retail footprint, customer base/traffic, profitability, and shop layout/condition play an important role when reducing the retail footprint.

Before COVID-19

Sustainable change in consumer behavior

At the same time, as consumers increasingly shifted toward online channels during the past year, telco providers were pushed toward the improvement of their sparse online offerings to be able to secure their overall sales. We believe that this change in consumer behavior toward online channels will be sustainable and telcos need to act and adapt accordingly.

Taking the general movement toward online channels and the recent acceleration into account, telcos urgently need to align their channel mix accordingly. Consumers prefer an omnichannel strategy, i.e., the seamless coverage of the sales process across all channels. Many of them start their sales experience in a retail store but finish it via a different channel, which requires telcos to connect their physical and their digital offerings more closely to create a smooth, overarching retail experience. When switching between channels, consumers expect their personal information to be saved instead of re-entering it again. Besides the call for personalized offerings, customers demand simplicity from telco providers in the buying and service process, similar to processes they know when purchasing other products e.g., from Amazon.

The demand for convenience is not fulfilled by telco providers yet, as many of them are trapped in outdated and non-contemporary structures, also affecting overall customer satisfaction.

Omnichannel excellence and simplicity

In order to satisfy consumer expectations of a seamless channel experience, the development and implementation of an omnichannel strategy are required, which may also involve a review of the current operating model and the overall structure of the sales organization. An omnichannel strategy involves different touchpoints, which aim to provide comprehensive coverage of all sales channels, both on- and offline. Thus, the format of the offline store must also be adapted from undifferentiated store concepts to tailored store designs according to the location and purpose of the store. For example, as customers are increasingly looking for a shopping experience instead of the purchase itself, and flagship stores/showrooms can be introduced to vivid locations in the city center to serve the purpose of promoting brand awareness and products.

As physical and digital channels are increasingly conflating and retail stores becoming one part of an overall seamless customer experience, sales do not have to be the primary purpose and sole measure of store success anymore. The channel in which the customer eventually purchases a product or service becomes less important. A showroom, for example, does not need to have significant in-store sales, but should rather increase brand perception and awareness, attract new customers, and increase brand loyalty.

Consequently, to satisfy changing customer behavior in the future, operators not only need to continuously re-assess how to best integrate physical and digital channels, but also how the local network of physical stores with various store formats can offer best-in-class customer experiences and in which way they can contribute to overall sales.

Key questions

- What is the current sales channel mix and future sales strategy?

- What is the optimal number of physical stores?

- What is the degree of physical and digital channel integration?

- What is the future purpose of each channel?

- Are the operating model and sales organization futureproof for omnichannel excellence?

Summary

Consumers' continuous shift toward online channels pushes telcos toward the improvement of their sparse online offerings. While telcos are significantly optimizing their physical retail footprint, an increased growth of digital channels has so far failed to materialize. The demand for an omnichannel strategy, personalized and simple, is currently not fulfilled by most of the telco providers.

However, the current accelerated shift toward digital channels and the sustainable change in consumer behavior offers a great chance for telcos to act and re-assess how to best integrate physical and digital channels. By doing so, telcos need to examine the role of the various channels to offer a best-in-class customer experience and achieve an overall boost in sales. This means that, as an example, a store’s main purpose might shift from pure sales toward increasing brand perception, loyalty, and awareness.

Sources: Fortlane Partners

ContactGet in touch