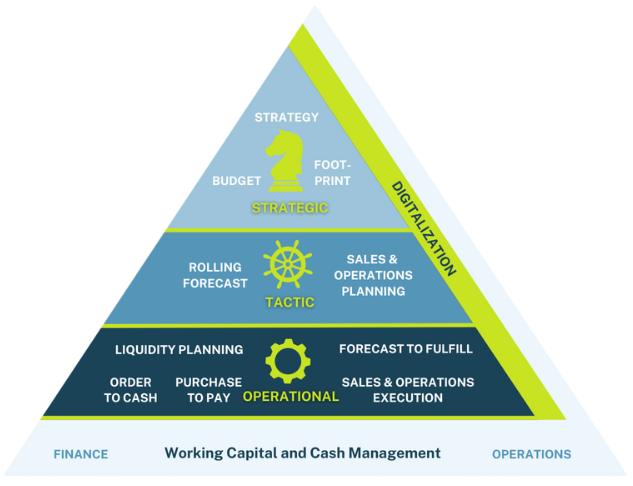

ExpertiseWorking Capital and Cash Management

Optimizing cashflow and working capital

It is no secret that inflation, geopolitical uncertainties, volatile raw material and energy prices, not to mention disrupted supply chains and value chains, are the hallmarks of the current market environment. Given this, companies must focus their attention on the efficient management of working capital, cash and supply chains if they are to embrace and exploit this paradigm shift.

Optimizing working capital, however, demands greater transparency, perfectly coordinated multidimensional processes and cross-functional collaboration. But fulfilling all these criteria is a tall order, and requires organizations to holistically scrutinize and often completely rethink their strategy when it comes to working capital, cash and the supply chain. In conjunction with clients from a wide range of industries, we have a proven track record in creating this transparency as well as drawing up and implementing successful strategies. Furthermore, we are also able to significantly and sustainably reduce the cash conversion cycle.

X "Companies overlook the importance of cash. We unlock cashflow potential, improving transparency and financial performance."

"Companies overlook the importance of cash. We unlock cashflow potential, improving transparency and financial performance."

Pirmin Mutter, Principal at Fortlane Partners

INSIGHTWorking Capital, Cash and Supply Chain Management

How can you improve liquidity, financial stability, and resilience in your business and along your supply chain? We strategically optimize the flow of information between finance and operations departments. This brochure provides a comprehensive overview of our services. Learn more now!